Projecting some farm economics trends for 2023

At this point we should all be immune to fortune tellers. Nothing against them personally, but when was the last time you heard anyone correctly predict anything of significance? Weather? Elections? Human behavior?

We keep saying this, but here it is again: we’ve lost our ability to use long-term historical trends to determine our path forward. The way the pandemic shutdowns tangled up our complicated globalized marketplace and changed consumer behavior will take years to sort out, proven by our recent inflationary challenges and now rising interest rates. Predicting what this will mean for the family farmer and the soil health industry could be a foolish undertaking, but as the pillars of convention erode, the need to replace that foundation with something else grows more important.

Looking ahead to 2023, these pillars are likely to start to take shape. The early pioneers of natural organic fertilizers — many of whom have written in the pages of this magazine — are likely to see a much larger marketplace blooming, but a major increase in competition as well. This is no fad. Established organic companies selling natural fertilizers, biologicals and fungal applications have spent the last three years building strong market positions due to heavy demand. The biological industry in the next seven years is supposed to triple, according to USDA, and most of that growth will happen domestically, as the cost of importing foreign inputs has grown by almost 90 percent since 2019. One caveat is that a significant detail is still missing that will warp the trust in biological products: a widely accepted definition of “biological.” I invite Acres U.S.A. readers to give this one a shot.

I would expect more climate funding. The 2022 climate funding from the USDA made a significant impact for organizations and individuals working to improve soil health. That money will start to see action in 2023, meaning new research teams and funding for regenerative farms. At the same time, many companies and organizations were left off incorrectly, so the tailwind was not as significant as it could have been. While I know some shy away from government assistance — I can’t argue with that approach — I have faith in our community that we will use this money correctly, precisely because of our innate reluctance to bend toward subsidies. While the funding is needed now to help farmers and ranchers offset the risks and realities of changing farm systems, the success of regeneration must not depend on the government IV drip.

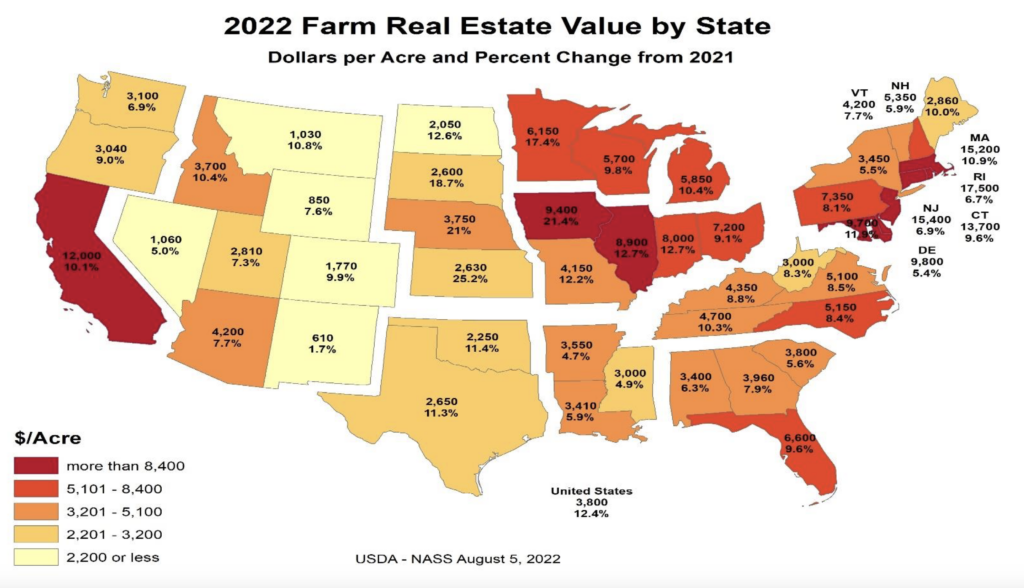

Farmland values get more complicated. Don’t we want farmers to get rich? The same week I wrote this column, a farm in Iowa sold for $30,000 an acre, at a total value of more than $2 million. Land values in Iowa have increased by 19 percent in the past year, which is about average across the country — an increase economists are connecting to the large federal bailouts in 2020 that boosted cash holdings. Because farmland is a fixed resource, and because it is now the hobby of billionaires to buy up farmland en masse, I don’t expect this trend to change anytime soon. While it is fair to expect some farmers to cash out and liquify their wealth, more consolidation adds pressure on yield-per-acre metrics, which got us into this inequitable position with big industry in the first place.

China will continue to be a major consideration within agriculture. Their pandemic lockdowns and punitive decisions that still affect global agricultural trade look to be waning, although that will likely not benefit the regenerative family farmer — unless the demand can somehow improve prices across the board on vegetables and high-nutrient food. But when a country that houses one in seven of our world’s population opens or closes its market, expect it to have an effect, even in the smallest of corners.

If you’re in the praying mood, say one for the hundreds of congressional interns who will be spending their summers learning how to spell “mycorrhizal fungi.” The 2023 Farm Bill will be the big buzz this year, so we should expect a gaggle of buzzwords to be thrown into the mix as congressional teams digest regeneration, biologicals, microbial life, livestock integration, ag robotics, drones, carbon markets and tractors with artificial intelligence. They also will bend their ear to a number of testimonies telling them that livestock and tillage are bad for the environment, and then to others informing them that these practices are good. I wouldn’t expect them to grasp it all as they decide how to spend the estimated $1.2 trillion.

Lastly, here are a couple other economic trends to pay attention to:

• Young farmers: Something has to give. With the average age of a farmer being 57.5 and getting older, and two-thirds male, expect more young and women farmers to enter the industry. The 2017 census showed that 27 percent of farmers had less than 10 years of experience, although the average age of the new farmer was still 46.5. Women now make up more than one-third of all decision-makers on farms, and that number will continue to increase. One dampening on these numbers is the fact that more and more farmers, regardless of gender, are taking multiple jobs to make the economics work at home.

• Insurance: With the potential of a recession, and the expected growth in the Supplemental Nutrition Assistance Program to 76 percent of the Farm Bill budget, the likelihood of more money coming in for insurance is unlikely, according to American Farm Bureau Economist Shelby Myers. This will put more pressure on developing naturally resilient farming systems, which we know is one of the big strengths of Acres U.S.A. readers.

• Direct marketing: Now worth more than $11 billion according to USDA estimates, the direct-to-consumer industry will continue to grow. The practice provides higher margins for farmers and ranchers, despite the complexities of starting up. As more farm directing marketing operations come online, cooperative sorting, processing and packaging facilities will help offset the startup costs faced by early adopters.

Hopefully this look ahead will, at the very least, help us understand the long-term nature of the volatility in agricultural markets. As we see inflation rates start to decrease and the fog of recent world events start to burn off, it will hardly be “back to normal.” What is emerging in front of us is a new landscape for agriculture — one retracting from all-in globalization and becoming more diverse. Resilience will be the name of the game … but as a reader of Acres U.S.A., you already knew that.

Ryan Slabaugh is the founder of Think Regeneration, a think tank and leadership academy accelerating real change in the regenerative movement. Learn more at thinkregeneration.com and contact him at ryan@think-regen.com. He was the executive director of Acres U.S.A. from 2016 to 2022.